Top Features to Look for in an Accounts Reconciliation Service Provider

|

Getting your Trinity Audio player ready...

|

Choosing the right account reconciliation service provider is crucial for maintaining accurate financial records. Reconciliation errors can lead to discrepancies that impact decision-making and compliance. You need an efficient, secure, and scalable provider to avoid these risks. Read along as we discuss more about the key features to consider.

What is Account Reconciliation?

Account reconciliation refers to the process of comparing two sets of records to make sure they match. This typically involves matching a company’s internal financial records with external records like bank statements. The goal is to verify that all transactions are accurate and properly recorded so there are no discrepancies between your financial statements and bank data.

Why Account Reconciliation is Important

Account reconciliation is an important step in maintaining accurate financial records. If discrepancies go unnoticed, they can lead to errors in financial reporting, affecting decision-making and regulatory compliance. This process helps you:

- Maintain data accuracy in financial management by identifying any errors or missing transactions.

- Keep track of your cash flow and ensure all payments and deposits are properly accounted for.

- Spot potential fraud or financial mistakes early, helping you avoid bigger issues later.

- Make strategic financial decisions based on accurate data.

Challenges in Manual Reconciliation

Manual account reconciliation can be time-consuming and prone to human error. Some common challenges include:

- Time consumption: Manually checking each transaction can take hours, especially if there are many records to review.

- Human error: Mistakes are more likely when reconciling data by hand. Small errors can go unnoticed and cause larger discrepancies later.

- Complexity: As your business grows, so does the complexity of your financial transactions, making it harder to track everything manually.

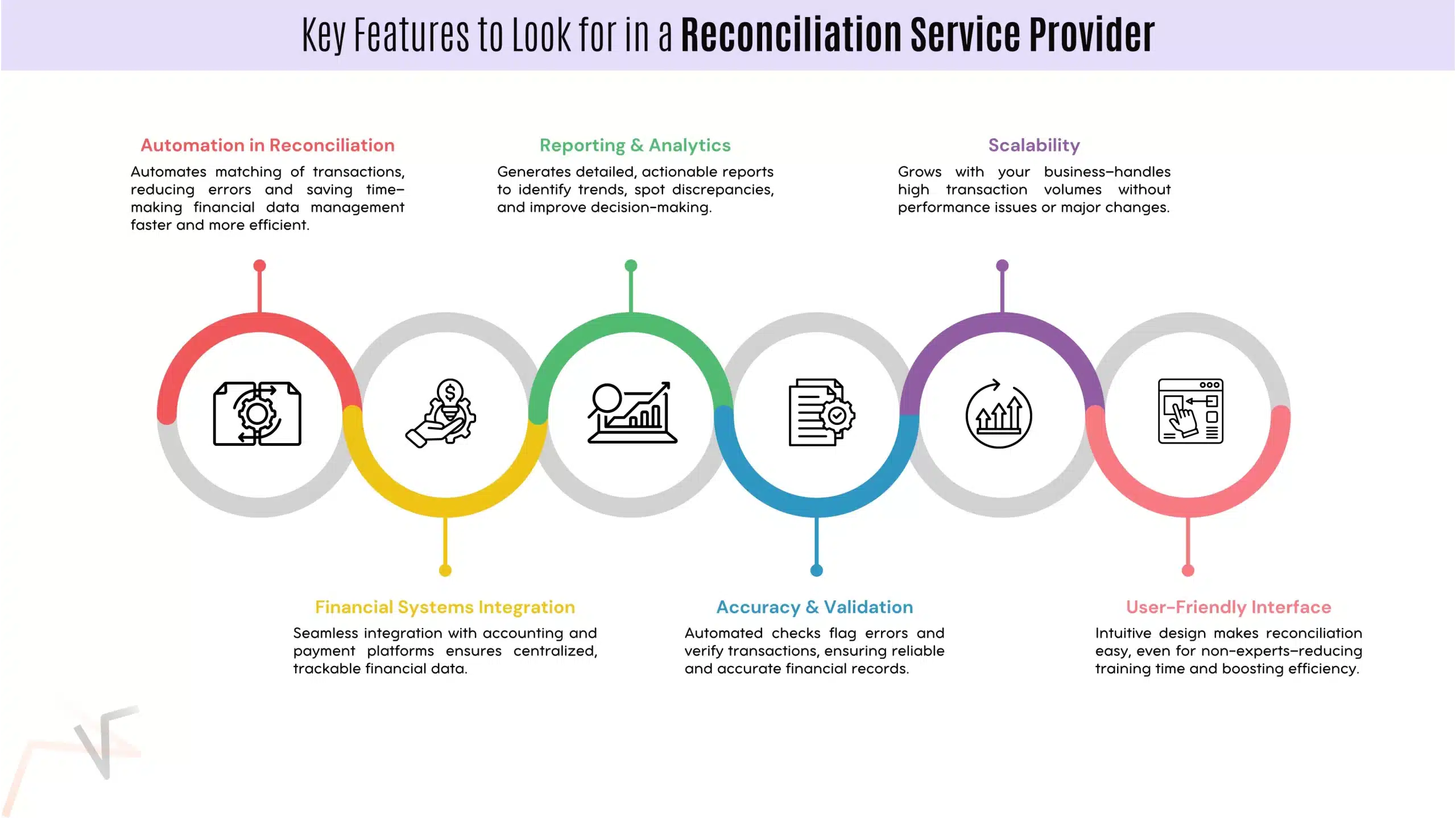

When selecting a reconciliation service provider, it’s crucial to focus on key features that will streamline your financial processes, improve accuracy, and provide the flexibility your business needs. Below are the essential features to consider.

Automation in Reconciliation

Automation in finance operations speeds up the reconciliation process by automatically matching transactions between internal records and external sources, such as bank statements. This reduces human error and frees up valuable time for other tasks, resulting in fewer mistakes and more efficient financial data management.

Integration with Financial Systems

A good reconciliation tool should integrate seamlessly with your existing financial systems (accounting software and payment platforms). This integration ensures that all your financial data is centralized and easier to track and manage.

Reporting & Analytics in Reconciliation

Accurate and insightful reporting is key to making informed financial decisions. A service provider with robust reporting and analytics features provides a clear view of your financial data. These tools can generate detailed reports, helping you spot trends, understand discrepancies, and measure the importance of reconciliation over time.

Accuracy & Validation in Reconciliation

Maintaining data accuracy in financial management is crucial. Choose a provider that offers strong validation features, checking the accuracy of each transaction and automatically flagging discrepancies. The system should also highlight potential errors for review, helping to ensure your financial records are always correct.

Scalability of Reconciliation Services

As your business grows, so will the volume and complexity of your financial transactions. It’s important to select a scalable reconciliation service. This means it can handle increased transaction volumes without slowing down or requiring a significant overhaul.

User-Friendly Interface for Reconciliation

Ease of use is crucial, especially if your team is unfamiliar with complex financial systems. A user-friendly interface will make it convenient for your staff to navigate the system and carry out account reconciliation without much training. Choose a tool with intuitive navigation and clear instructions, reducing the learning curve and improving overall efficiency.

Benefits of Automated Reconciliation

Automating the reconciliation process offers several benefits, from improving efficiency to helping manage risks more effectively. Here are some of its key advantages.

Efficiency & Cost Savings

With automated bank reconciliation, tasks that took hours can now be completed in minutes. Automating the reconciliation process reduces manual efforts and avoids spending time on repetitive checks. This leads to better cost savings, as fewer resources are required to manage financial data.

Additionally, automation reduces human error, saving you money in the long run by preventing costly mistakes. The importance of reconciliation is reflected in how much quicker and more accurately it can be done, allowing you to focus on other critical areas of your business.

Enhanced Risk Management

Automated reconciliation tools help you quickly spot discrepancies, making it easier to address potential risks early on. With automation in finance operations, errors or mismatches are flagged immediately, reducing the chances of fraud or reporting mistakes. This leads to better risk management and helps maintain the importance of data accuracy in financial management.

How ProcessVenue Can Help with Accounts Reconciliation

ProcessVenue offers a streamlined account reconciliation solution that improves accuracy and efficiency. With its automated reconciliation features, you can easily match your internal records with external data, such as bank statements. This helps reduce errors and the time spent on manual checks.

The platform integrates with your existing financial systems, making it easier to manage data and minimize the risk of discrepancies. Automated bank reconciliation ensures transactions are matched quickly, giving you more control over your financial data.

Conclusion

Selecting the right account reconciliation service provider helps you maintain financial accuracy, save time, and reduce risks. Look for a solution that offers automated reconciliation, security, scalability, and ease of use. You can improve efficiency and focus on strategic financial decisions by choosing a solution provider with these features, such as ProcessVenue.

FAQs

How can automation improve account reconciliation?

Automation speeds up reconciliation by automatically matching transactions, reducing human error, and freeing time for other tasks. It makes the entire process more efficient and accurate.

Why is it important to integrate financial systems in reconciliation services?

Integrating financial systems ensures that all your data is centralized and easily accessible. This reduces manual data entry and prevents discrepancies, improving the overall accuracy of your reconciliation.

What are the benefits of automated reconciliation for businesses?

Automated reconciliation saves time, reduces errors, and increases efficiency. It streamlines financial processes, reduces the risk of fraud, and helps maintain accurate financial records.

What role does scalability play in choosing an accounts reconciliation provider?

Scalability allows the reconciliation service to grow with your business. As your transaction volume increases, the provider should handle larger data sets without compromising performance or requiring major changes.

How can user-friendly interfaces improve reconciliation workflows?

A user-friendly interface simplifies the reconciliation process, reducing the learning curve and making it easier for your team. It leads to faster, more efficient workflows and fewer mistakes.