Benefits of Outsourcing Finance and Accounting Services

Outsourcing finance and accounting services is a strategic decision to help your business reduce costs, gain access to expert knowledge, and improve operational efficiency. Instead of dedicating internal resources to complex financial tasks, you can rely on experienced professionals to handle them, allowing you to focus on scaling your business.

In this blog we will explore:

- Key Benefits of Outsourcing Accounting and Finance Services

- Cost Savings Through Outsourcing Accounting Services

- Reducing Overhead and Operational Costs

- Avoiding Costs of In-House Hiring and Training

- Access to Expertise and Specialized Skills

- Leveraging Professional Knowledge and Experience

- Staying Up-to-Date with Accounting Regulations

- Improved Efficiency and Focus

- Streamlining Financial Processes

- Freeing Up Internal Resources for Growth

- Scalability and Flexibility in Financial Services

- Adjusting Resources According to Business Needs

- Flexible Solutions for Seasonal or Variable Demands

- Enhanced Financial Security and Compliance

- Ensuring Compliance with Tax Laws and Regulations

- Protecting Sensitive Financial Data

- Conclusion

- FAQs

FAQs

- How can outsourcing finance and accounting services improve my company’s financial accuracy?

- What are the key risks of outsourcing accounting, and how can they be mitigated?

- How do I choose the right outsourcing partner for my company’s accounting needs?

- Can outsourcing accounting services help with tax planning and preparation?

- What makes ProcessVenue a trusted partner for finance and accounting outsourcing?

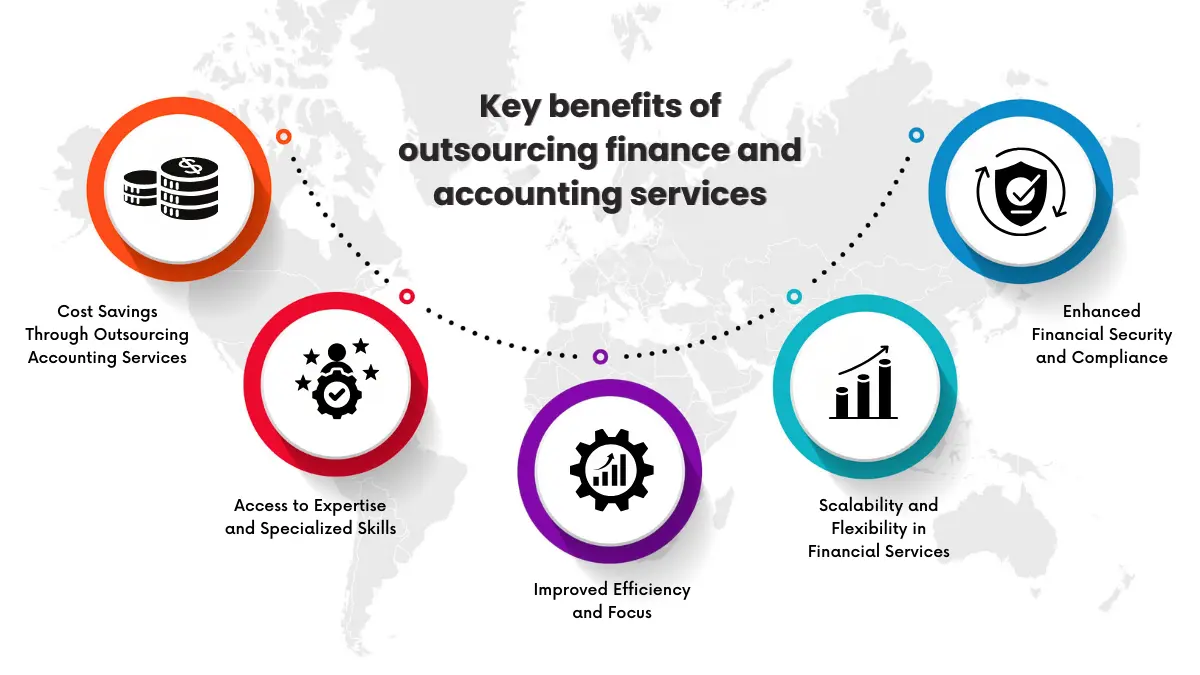

Key Benefits of Outsourcing Accounting and Finance Services

Here are some key benefits of outsourcing finance and accounting services.

Cost Savings Through Outsourcing Accounting Services

Outsourcing allows businesses to lower overhead costs by eliminating the need to maintain an in-house accounting team. By partnering with an outsourcing provider, companies can access professional services at a lower cost.

Reducing Overhead and Operational Costs

- No Need for Infrastructure: In-house teams need a working space, computers, and software. Outsourcing providers handle these costs on their end, reducing your expenses.

- Pay Only for What You Need: Outsourcing enables you to go for specific services like bookkeeping services, payroll services or tax services. This saves a lot of money as it does not involve having to employ people to perform accounting tasks full-time.

- Savings on Technology and Tools: Software licenses, especially the ones used in accounting firms are fairly pricey, more so when it comes to acquiring updates. Some of the providers of outsourcing services incorporate specialized accounting systems as part of their service, thus saving you costs on such tools.For example, for startups with limited resources, outsourcing finance functions allows them to access expert services without a heavy financial burden, helping them grow without compromising on accuracy or compliance.

Avoiding Costs of In-House Hiring and Training

- High Recruitment Costs: Recruiting professional accountants means coming up with job openings, interviewing candidates as well as hiring which all consume time and money. By outsourcing certain activities, you can easily cut down on these costs.

- Training Expenses: Keeping your in-house team updated on accounting standards or tax regulations changes can be costly. Outsourced firms come with pre-trained experts who stay current on industry developments.

- Reduced Risk of Turnover: Replacing an employee in a finance position causes operational inefficiency and brings a new hiring cost. Outsourcing ensures continuity without these challenges.

For example, small businesses can avoid the high costs associated with recruiting and training an in-house accounting team, while also benefiting from the expertise of seasoned professionals without the associated risks.

Access to Expertise and Specialized Skills

Outsourcing gives you access to qualified personnel in your job who are conversant with modern practices and requirements.

Leveraging Professional Knowledge and Experience

- Advanced Expertise: Outsourced accountants are often highly qualified, with certifications like CPA (Certified Public Accountant) or CMA (Certified Management Accountant). They can manage everything from financial reporting to complex audits.

- Industry-Specific Knowledge: Most outsourcing companies focus on particular sectors, guaranteeing that your accounting procedures meet sector standards and compliance.

- Strategic Insights: With access to accurate and timely financial data, outsourced professionals can provide insights into cost-saving opportunities, revenue trends, and financial risks.

Staying Up-to-Date with Accounting Regulations

- Compliance with Tax Laws: Outsourcing firms always make sure that your tax filings are correct as well as legal under the current laws.

- Adherence to Financial Standards: Certified standards such as GAAP or IFRS call for precise expertise and constant knowledge updating. Outsourcing helps to ensure these are followed without any mistakes.

- Risk Mitigation: Outsourced experts constantly watch the changes in laws so you will not suffer from financial or legal consequences.

Improved Efficiency and Focus

Outsourcing financial tasks helps to optimize processes and allocate internal resources to work on the growth of the company.

Streamlining Financial Processes

- Efficient Workflows: Outsourced providers apply certain steps to accomplish the payroll processing, accounts payable/receivable, and monthly reconciliation systematically.

- Automation and Technology: A good number of outsourcing firms incorporate professional accounting techniques, and implement automation to improve efficiency and eliminate mistakes.

- Reduced Errors: Outsourcing also helps in minimizing errors in the financial options, the things which play a critical role in the decisions making and compliance.

Freeing Up Internal Resources for Growth

- Focus on Core Activities: This relieves your team of the burden of managing the financial aspect so that they can stay focused on main responsibilities such as product creation, sales and customer support among others.

- Scalability: Outsourcing is essential because it makes it easier for you to scale services as you grow bigger. For instance, when contacting a large number of clients, it is possible to increase the range of services without having to increase the number of employees.

- Better Resource Allocation: Fewer resources are locked up in back-office functions, which means that the savings can be reinvested in growth activities, like advertising or entering new markets.

Scalability and Flexibility in Financial Services

Hiring an outsourcing service provider for finance and accounting means you can scale your financial processes in response to your business. It helps to have enough support whether you have constant growth or the kind that comes and goes in cycles.

Adjusting Resources According to Business Needs

- Adaptable Team Size: Outsourced financial providers can easily flex up or flex down depending on the needs that you have. For instance, during periods of growth, they can hire more people or increase working hours dedicated to transactions, reporting or compliance.

- Cost-Effective Scaling: You do not have to invest in having new employees and training them to cater to the increasing needs. Outsourcing also means that the costs will be well regulated because you only pay for the services you obtain.

- Support During Transitions: In a new product launch, a new market entry or restructuring, for instance, outsourcing allows for more workload to be managed without necessarily compromising on the main business model.

Flexible Solutions for Seasonal or Variable Demands

- Managing Seasonal Peaks: For industries that experience variable demand throughout the year, outsourced providers can scale up staffing to meet, for example, a flood of invoices that comes at holiday time for retailers.

- Temporary Adjustments: External service providers can scale down their degree of participation during a low phase of business operations, thus resulting in reduced expenses.

- Tailored Services: Outsourcing firms provide flexible solutions and it is possible to choose the services that are required at any given time, such as payroll processing services during the tax period, and complete accounting services during expansion.

Enhanced Financial Security and Compliance

Outsourced financial services support you to meet regulatory policies when adopting a secure approach to the protection of your valuable information.

Ensuring Compliance with Tax Laws and Regulations

- Proactive Monitoring: Outsourcing providers constantly follow the changes in tax laws and financial regulations to guarantee your business complies with the law. This is especially true if you conduct business in several areas, which means that the taxation policies will differ.

- Accurate Filings: Accomplished professionals do taxes in a timely and accurate manner which minimizes the possibilities of audits, penalties, or fines. For instance, they will handle issues to do with filing of goods and services tax, or payroll taxes depending on the regulations of the region.

- Industry-Specific Expertise: Most outsourcing firms in financial operations deal with the healthcare sector, retail sector or the manufacturing sector to make sure that your financial operations are in compliance with the industry.

Protecting Sensitive Financial Data

- Advanced Security Measures: Outsourced providers use secure systems and encrypted software to protect your financial data. They often comply with international security standards like GDPR (General Data Protection Regulation) or ISO (International Organization for Standardization) certifications.

- Access Controls: To guard against unauthorized access, these firms have what may be termed access control mechanisms in handling or dealing with your financial data.

- Disaster Recovery Plans: Most of the providers have reliable systems of backing up data and disaster recovery to ensure that your data is safe from loss originating from system crashes or cyber criminals.

Conclusion

Outsourcing finance and accounting services offers significant advantages, from cost savings to improved efficiency. You gain access to specialized expertise, scalable solutions, and robust data security by choosing outsourced finance and accounting. It lets your business focus on growth while leaving critical accounting services to skilled professionals.

ProcessVenue has been in the business for more than 15 years offering outsourcing accounting services that will suit your needs. Organizational change is relentless, and our secure, reliable, and scalable solutions keep your business operations top of mind. Whether you need basic business accounting services or comprehensive outsourced finance and accounting solutions, ProcessVenue assists you in enhancing your performance and keeping your data fully secure.

FAQs

How can outsourcing finance and accounting services improve my company’s financial accuracy?

Outsourcing business accounting services means that your financial duties shall be in the hands of professional accountants thus minimizing chances of accounting and reporting mistakes. This also offers a path to sophisticated features and techniques to increase precision and conformity.

What are the key risks of outsourcing accounting, and how can they be mitigated?

The primary risks that have been identified include threats to data integrity and possible communication breakdown. These can be minimized by selecting a certified provider with sound information technologies, processes and good communication channels.

How do I choose the right outsourcing partner for my company’s accounting needs?

When hiring outsourced business accounting services, choose the service providers who understand your business, have the right certifications, and have positive feedback from their customers. Assess how safe they are, how they communicate, and if they can adjust their products and services to your preferences.

Can outsourcing accounting services help with tax planning and preparation?

Yes, outsourcing business accounting services provides an opportunity to engage professional tax advisors to make the necessary filing and compliance with set tax laws. They can also mitigate tax risks and find ways to save taxes and can also be useful for strategic planning.

What makes ProcessVenue a trusted partner for finance and accounting outsourcing?

ProcessVenue offers certified professionals, secure data handling, and tailored services to meet unique business needs. With a focus on accuracy, compliance, and transparency, we deliver reliable financial solutions.