Is Payroll Outsourcing Right for Your Firm? Key Considerations

Businesses often face a tough decision when managing payroll: to manage it within the organization or hire outsourcing payroll services. Payroll is not just about paying employees’ wages but it includes taxes, employees’ benefits and their records in large organizations.

Whether outsourcing payroll is wise for your business is determined by some aspects such as; cost, efficiency and expertise needed. In this article, you are going to learn some important factors to enable you to determine if your company can benefit from managed payroll services. Read along!

In this blog we will explore:

-

- What is Payroll Outsourcing, and How Does It Work?

- Understanding Payroll Outsourcing Services

- Benefits of Outsourcing Payroll

- Key Considerations Before Outsourcing Payroll

- Cost vs. Benefit Analysis

- Ensuring Compliance with Local and National Laws

- Factors to Evaluate When Choosing a Payroll Partner

- Evaluating Experience and Reputation

- Technology and Security Considerations

- Challenges in Payroll Outsourcing

- Managing Data Privacy and Confidentiality

- Ensuring Seamless Integration with Existing Systems

- Is Payroll Outsourcing Right for Your Business?

- Determining the Right Time to Outsource Payroll

- Choosing Between In-House vs. Outsourced Payroll

- Conclusion

FAQs

- What are the potential cost savings of outsourcing payroll for my business?

- How can payroll outsourcing improve the accuracy of employee compensation?

- What should I look for in a payroll outsourcing partner to ensure smooth integration?

- How does payroll outsourcing help mitigate compliance risks for my firm?

- How does ProcessVenue ensure seamless payroll management for its clients?

What is Payroll Outsourcing, and How Does It Work?

Payroll outsourcing means that a company hires a third party to take on the responsibility of processing payroll, including finding the amount of each employee’s compensation, the taxes that should be deducted from the compensation, legal requirements, and employee benefits.

This saves you lots of time having to do payroll within your organization.

Understanding Payroll Outsourcing Services

Payroll outsourcing services cover several critical tasks, including:

-

- Salary Calculations: The correct computation of salaries, overtime, and deductions.

- Tax Management: Managing tax returns and the obligations that stem from compliance with municipal and federal tax legislation.

- Payslip Generation: Issuing pay slips to employees and presenting them to the relevant employee bodies.

- Benefits Administration: Managing employee benefits like healthcare or retirement contributions.

- Compliance Support: Compliance with labor laws in order not to be penalized for violation.

- Reporting: Offering reports that give elaborate information concerning payroll costs and the overall costs of employees.

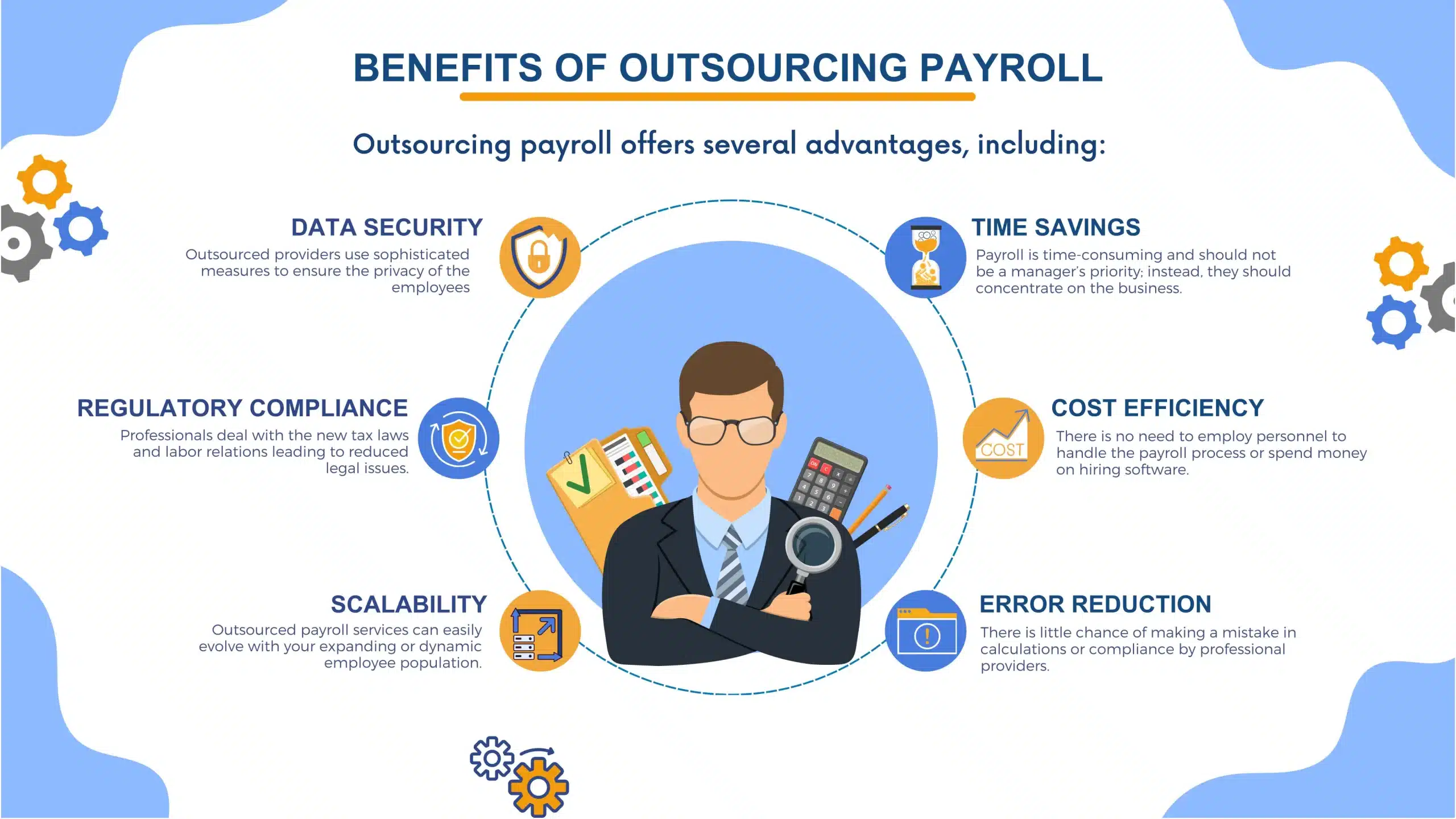

Benefits of Outsourcing Payroll

Outsourcing payroll offers several advantages, including:

- Time Savings: Payroll is time-consuming and should not be a manager’s priority; instead, they should concentrate on the business.

- Cost Efficiency: There is no need to employ personnel to handle the payroll process or spend money on hiring software.

- Error Reduction: There is little chance of making a mistake in calculations or compliance by professional providers.

- Scalability: Outsourced payroll services can easily evolve with your expanding or dynamic employee population.

- Regulatory Compliance: Professionals deal with the new tax laws and labor relations leading to reduced legal issues.

- Data Security: Outsourced providers use sophisticated measures to ensure the privacy of the employees.

Key Considerations Before Outsourcing Payroll

As with any business decision, a number of factors have to be looked at when trying to determine if payroll outsourcing is the way to go. By critically analyzing these factors, you shall be in a position to determine whether outsourcing is suitable for you or not.

Cost vs. Benefit Analysis

One of the most important things that should be done before outsourcing payroll is the assessment of the cost-benefit analysis. There are some companies out there who think that outsourcing is costly, but, in fact, when you weigh up the costs of overheads, mistakes, and time wasted on processing payroll internally, it is actually cheaper.

To make a better decision, consider these factors:

- Labor Costs: Outsourcing payroll can help avoid having to recruit or even train an internal payroll department.

- Mistakes and Penalties: Outsourcing payroll services is cost-effective because it minimizes mistakes and cases that lead to penalties.

- Time Savings: Outsourcing of payroll responsibilities saves you time which can be used to manage other core business activities.

Ensuring Compliance with Local and National Laws

Outsourcing your payroll services helps providers make sure your business adheres to all the laws at the local, state, and federal levels. They concern themselves with taxes, deductions and other legal issues so that you don’t end up paying a fine.

Factors to Evaluate When Choosing a Payroll Partner

The selection of the best payroll service provider is very important in payroll processing. There are several factors that will help you make the right decision for your business, including:

Evaluating Experience and Reputation

When looking for a partner to outsource payroll processing, experience matters. You want to choose a provider with a proven track record of handling payroll for businesses like yours. Their experience in managing payroll tasks will help ensure accuracy and compliance.

Bonus tips:

- Check references: Look for customer reviews or speak to other businesses that have worked with them.

- Assess their track record: How long have they been in the payroll business? What type of clients do they serve?

Technology and Security Considerations

Payroll information must be protected because it is sensitive information. So, make sure your payroll provider follows an effective policy and employs secure systems to eliminate the risk of leaked employees’ and company information. Also, look for these features:

- Encryption: This means that information that is communicated to and from the network is protected.

- Backup systems: They should have a contingency plan in the event the system fails them.

- Cloud-based solutions: These permit easy access and can, in a way, help to minimize some risks with regard to data storage.

Challenges in Payroll Outsourcing

Like most outsourcing solutions, payroll outsourcing is not without its drawbacks. Knowing these can assist you to make a better decision.

Managing Data Privacy and Confidentiality

When you outsource payroll processing, ensure the provider has strong security measures in place, such as:

- Encryption: Secures data to prevent it from being accessed by other unauthorized people.

- Compliance: They should adhere to laws of data protection and regulations.

- Access Controls: Restricting the access of some individuals to the sensitive data that is contained in the payroll system.

Ensuring Seamless Integration with Existing Systems

When you choose to outsource your payroll, this has to align with the other tools that you are using. To do this, make sure the payroll service provider offers the following:

- Compatibility: Ideally, they should integrate with your existing accounting or human resource management system.

- Data Transfer: Smooth and safe transitions of data between the systems that reduce instances of keying in wrong information.

- Support: The provider should provide constant help with integration or help in case any problem arises.

Is Payroll Outsourcing Right for Your Business?

Whether outsourcing payroll is right for your business depends on the following factors. Here are some suggestions and things to note.

Determining the Right Time to Outsource Payroll

Outsourcing can be advantageous when you or your team spend too much time on payroll since it will create time for other important matters.

Also, look for signs such as:

- Increase in the number of employees, differences between their pay rates, or if there are new tax laws affecting pay.

- Rising errors or fines connected with payrolls.

- Inadequate knowledge or access to skills in regard to payroll functions.

Choosing Between In-House vs. Outsourced Payroll

If you are deciding on whether to handle your payroll internally or contract a third party to handle your payroll, then you should factor in the size of your organization and its requirements.

- In-house payroll can be more appropriate where the staff establishment is not very large and the processing of payroll is not very complex.

- Outsourcing of payroll is more advantageous where your business is expanding or where you want the pressure of managing the payroll to be taken off your hands.

Conclusion

Deciding whether to outsource payroll processing is a significant step for any business. It can lead to increased efficiency, reduced risk of compliance errors, and cost savings, but only if you make the right choice. At ProcessVenue, we offer outsourced payroll services tailored to your business needs, helping you streamline payroll management while maintaining compliance and protecting sensitive data. Contact us to know more.

FAQs

What are the potential cost savings of outsourcing payroll for my business?

The possibility of outsourcing payroll is helpful because it will reduce your overhead expenses. When you outsource your payroll, you do not have to employ employees and train them to specialize in managing payroll. You do not also pay costs for payroll software, tax penalties and other errors which could be costly.

How can payroll outsourcing improve the accuracy of employee compensation?

When you outsource payroll processing, you rely on experts who are trained to manage complex payroll tasks, reducing the chances of errors in salary calculations or tax deductions. Managed payroll services ensure that all aspects of payroll are processed accurately and on time, preventing costly mistakes and discrepancies in employee compensation.

What should I look for in a payroll outsourcing partner to ensure smooth integration?

To ensure smooth integration when you outsource payroll services, look for a partner with:

- Experience and expertise in handling payroll for businesses of your size and industry.

- Scalable solutions that can adjust as your business grows or changes.

- A strong focus on data security to protect sensitive information.

- A good track record when it comes to compatibility with your current systems for instance the HR or accounting software.

How does payroll outsourcing help mitigate compliance risks for my firm?

Payroll outsourcing reduces compliance risk because the outsourcing company assists the business in understanding the existing tax laws at the local state and federal levels. It also helps in the correct filing of taxes, correct deductions and most importantly their implementation as per the current laws of the country.

How does ProcessVenue ensure seamless payroll management for its clients?

At ProcessVenue, our core solution is managed payroll services that are designed to accommodate your specific requirements. Our outsourced payroll services include proficient salary computation and skillful management of taxes. Plus, we make sure that our integration with your current systems is seamless, deliver concise and punctual reports and guarantee utmost data protection.