KYC Compliance: Understand the Why, What, and How

KYC is an acronym for Know Your Customer. As more and more business is being transacted in the cyber world we have seen a rise in the spate of frauds and money laundering activities to fund nefarious acts. There was a growing need to keep a check on these. Reserve Bank of India, in a bid to curtail these came out with KYC guidelines for banks in the year 2002 and in the year 2004 made it mandatory for all banks to become KYC compliant by the end of the year 2005.

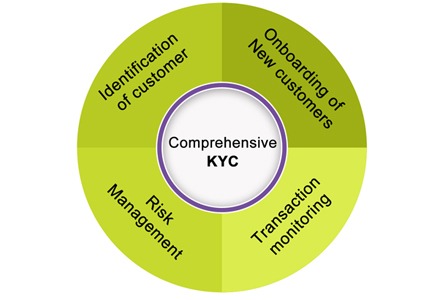

The objective of KYC is for the Banks to understand the customers better not just in terms of their whereabouts and identity but also knowing their transactional behaviors.

There are roughly around four key areas around which the KYC forms need to be built viz.

1. Customer Acceptance Policy

2. Customer Identification Procedures

3. Monitoring of Transactions and

4. Risk management

KYC is a legal and binding activity and one that can be revised time and again depending on the customer profile.

The Procedure:

The process of KYC requires identification of the customer’s address, and verification of his identity using reliable documents for gaining this information. While opening different accounts the concerned Banks or organizations collect all the relevant documents pertaining to the customer in a bid to ensure that the compliance to KYC guidelines issued by the RBI are met.

Situations Demanding KYC

Every financial institution has to adhere to KYC norms while transacting business with the customers. The customers need to provide the information so demanded in the following situations:

• For opening a Bank Account

• For a credit card or Loan application

• For opening a Subsequent Account

• For availing a Locker

• For incomplete documents for existing Bank Accounts

• For incorporating changes in signatories, nominees, beneficiaries, etc

• For when the banks need additional information from existing customers based on their transactional conduct

• For investing in mutual funds

This is not a comprehensive list and there may be other instances when the financial institutions seek information for KYC compliance from both the new and existing customers.

KYC – What the Banks require from Individuals?

For being KYC compliant for individual accounts, Banks require the following information and documents corroborating the same:

1. Legal name and any changes in the name made thereof

2. Correct and full permanent address

The prospective or existing customers have to present the original documents for verification and submit a copy to the bank for record keeping. These may include:

• Identity Proof (any one of the following documents)

i). Passport

ii). PAN Card

iii). Voter’s Identity Card

iv). Driving license

v). Ration Card

• Address Proof (any one of the following)

i). Utility bill (electricity, telephone, waterworks)

ii). Bank Account statement (received by mail/courier) along with signature verification by the Bank or a cheque drawn on the account

iii). Ration Card

iv). Letter from Employer on the Company Letterhead (subject to satisfaction of the bank)

KYC – What the Banks require from Companies / Organizations?

Documents Required for KYC may vary when it comes to Accounts of Companies, Firms, Trusts, and Partnerships etc. The Account holders may be requested to furnish their latest color Photographs along with duly filled and signed KYC forms. The banks may also call for periodic updates as and when they deem fit.

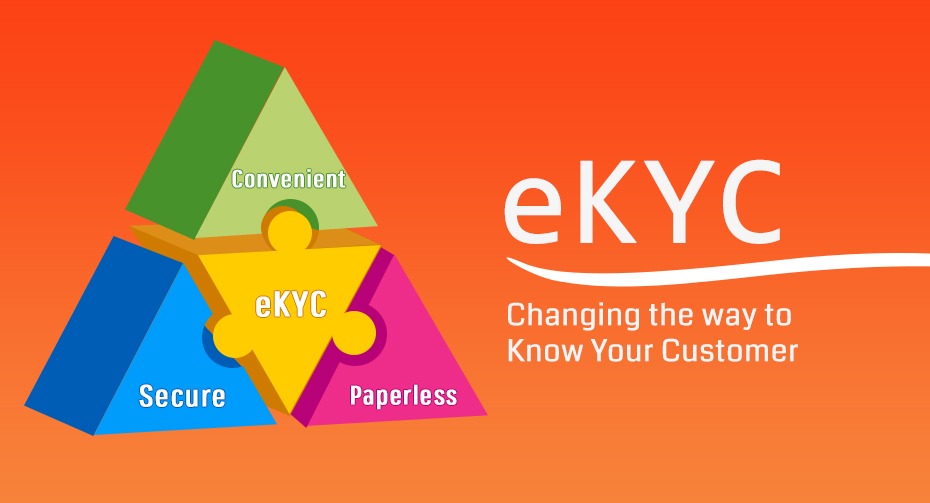

In the busy schedules we keep today KYC compliance has been made simpler through e- KYC process which basically means to fill out the necessary forms using the e- KYC Service providers who take the burden of keeping a tab on the customers and ensuring verifications and identification procedures are kept up-to -date and in conformance with the laid out guidelines. They help update, change and maintain the KYC details for you so that the business never suffers. In case of any delays and non – conformance the bank has the right to consider either closing the account or terminating the banking relationship after issuing due notice to the customer.