The Difference Between Accounting and Finance in Business

Understanding the difference between accounting and finance is crucial for anyone involved in finance in business. While both fields deal with money, they focus on different aspects of managing finances. Accounting in business mainly involves tracking and reporting financial transactions, while finance in business focuses on planning, managing, and analyzing the allocation of resources for future growth. Let’s explore these differences further.

What is Accounting, and what does it do for a company?

Accounting is the process of recording, classifying, and summarizing financial transactions to provide an accurate picture of a company’s financial health. It tracks past transactions, such as sales and expenses, and ensures compliance with regulations. Accounting helps companies understand their profitability, cash flow, and financial position, providing vital data for decision-making.

What is Finance, and what does it do for your company?

Finance involves managing a company’s financial resources to achieve its long-term goals. It focuses on planning, investing, budgeting, and analyzing financial data to ensure profitability and growth. Finance is about making strategic decisions on where to allocate resources, whether through investments, financing, or managing risks.

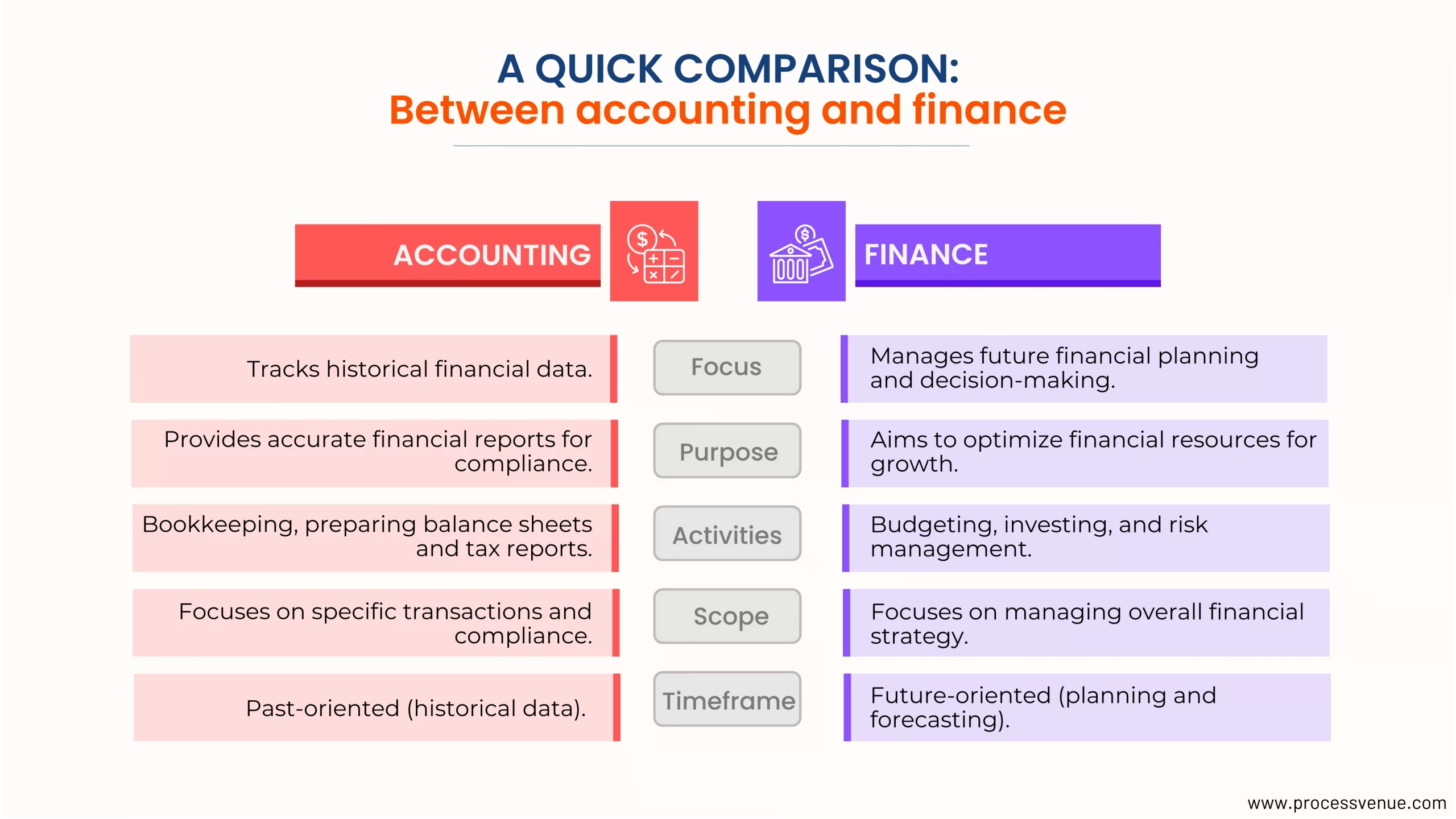

What’s the difference between accounting and finance, then?

Here’s a quick comparison:

Understanding the different types of finance and accounting helps you choose the right approach for managing money or business operations. Here’s an overview of the various types:

Types of Finances

Finance comes in different forms based on who manages the money and the goals it aims to achieve. The types of finance include:

Personal

Focuses on managing individual finances, including budgeting, saving, investing, and planning for retirement.

Corporate

Involves managing the finances of a company, including raising capital investments and managing risks for business growth.

Public

Deals with government revenue collection (like taxes) and allocating resources to provide public services.

Behavioral

Studies how psychological factors and emotions affect financial decision-making, often in investment markets.

Social

Involves using financial tools and investments to create social or environmental benefits alongside financial returns.

Types of Accounting

Accounting covers various areas of managing and reporting financial information. Different types include:

Financial

Focuses on recording, summarizing, and reporting financial transactions to external stakeholders like investors and regulators.

Public

Involves providing accounting services such as auditing, tax preparation, and consulting for various clients, including businesses and individuals.

Forensic

Combines accounting, auditing, and investigative skills to detect and investigate financial fraud or disputes.

Management

Provides internal financial information to help managers make informed decisions about business operations, including budgeting and performance analysis.

Tax

Focuses on preparing tax returns, ensuring compliance with tax laws, and advising on tax planning strategies.

Audit

Involves examining and verifying financial records to ensure accuracy and compliance with accounting standards and regulations.

Where do we use Finance and Accounting?

Both finance and accounting are used in many business areas to manage money and make informed decisions. Here’s where you use them:

- Finance is used for making long-term investment decisions, managing cash flow, and planning business growth.

- Accounting is used for tracking day-to-day financial transactions, preparing financial statements, and ensuring compliance with tax regulations.

Why do companies need both finance and accounting?

Companies need both finance and accounting to keep their operations running smoothly:

- Accounting provides a clear record of past transactions and financial status.

- Finance helps in planning for the future, managing investments, and handling financial risks.

Together, they support overall business strategy and operational efficiency.

Finance or Accounting: Which Is Better for You?

Choosing between finance and accounting depends on your interests and career goals:

- If you enjoy analyzing financial data, planning investments, and making decisions based on trends, finance might be the right path.

- If you prefer working with numbers, preparing financial reports, and ensuring compliance with regulations, accounting could be a better fit.

Understanding the differences between accounting and finance will help you make the right choice based on your skills and career interests.

Conclusion

Both accounting and finance play vital roles in a business. While accounting helps track a company’s present financial status, finance involves making strategic decisions to improve its financial health in the future. Understanding the differences between accounting and finance allows businesses to manage their finances effectively, ensuring both short-term stability and long-term success.

FAQs

What is the relationship between finance and accounting?

Finance and accounting are closely related. Accounting tracks and records financial transactions, while finance focuses on managing these records to make strategic decisions, investments, and plans for growth.

In which way is accounting different from finance?

The difference between accounting and finance lies in their focus. Accounting is about recording, summarizing, and reporting financial data, while finance is about managing those finances for investment, growth, and risk management.

How does finance differ between personal, corporate, and public sectors?

In personal finance, individuals manage personal income, expenses, and investments. In corporate finance, businesses focus on maximizing profits, managing resources, and making strategic financial decisions. Public finance deals with government budgeting, taxation, and spending to serve public needs.

How does management accounting help businesses make decisions?

Management accounting provides business managers with financial insights, helping them make informed decisions about budgeting, cost control, and financial planning. It plays a crucial role in guiding business finance by offering data that supports strategic planning and performance improvement.